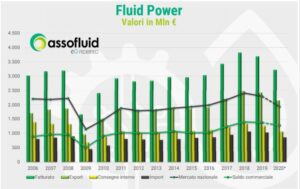

In this article we retrace the Fluid Power market data, starting from the pre-pandemic situation of 2020, up to some projections for the future.

In 2019, after years of strong growth, the Fluid Power sector in Italy experienced a setback. The decline occurred both in foreign demand (-2.1 points) and on the domestic market (-4.5 points). 2019 was characterized by a decrease in production (-3.4%) lower than the one of domestic consumption (-4.5%). Fluid Power in Italy, however, has reached almost 3.7 billion euros of production, with a domestic market that reaches 2.3 billion (sector report for 2019 drawn up by Assofluid and published in April 2020).

However, the decline in 2019 did not put at risk the result achieved with the recovery that began in the two-year period 2010-2011, after the crisis of the world economy in 2009: at the end of the year, both the production of the oil-hydraulic sector and of the pneumatic one are still well above the pre-crisis values.

The separate analysis of the two sectors reveals an uneven trend between hydraulics and pneumatics as regards the percentage variations of the items under investigation. It is evident that the global result of Italian Fluid Power, first attributable to the continuous growth of pneumatics, since 2017 shows hydraulics as the protagonist which, also in 2019, proved to be the sector best able to withstand the difficult market conditions, with losses lower than pneumatics in all the variables.

Regarding the difficult year of 2020, Federtec presented an in-depth survey (April 2021) on the trend of the Italian market for the fluid power sector (Assofluid). As regards the turnover of Fluid Power, pneumatics (-5.7%) absorbed the blow of the pandemic better than hydraulics (-14.6%). The difference is also found in terms of exports: a decrease of 2.6% was calculated for pneumatics, and 13.2% for hydraulics.

However, the different performance of the various quarters of 2020 must be highlighted. In fact, an important rebound was recorded in the last two quarters, which partly contained the negative situation of the first two: the recovery took place starting from the third quarter of 2020, above all thanks to the boost provided by exports.

After a negative 2020, the first quarter of 2021 records double-digit growth in orders: domestic orders +43.0% and foreign orders +41.5%, confirming the rebound for both pneumatics and hydraulics, bringing the economic results at 2019 values.

At the end of 2021, the data presented by Federtec (April 2022) demonstrate how the entire sector of the Italian industry of components and mechatronic technologies for fluid power has managed to obtain excellent results.

In detail, hydraulics recorded increases of more than 30% compared to 2020, showing better performances than pneumatics for all indicators. In terms of exports, hydraulics shows +31.9% against +22.9% for pneumatics (overall turnover in 2021 increased on the previous year by 31.5% and 27.2% respectively).

Also for the first quarter of 2022 (the most recent period to which the data found refer), compared to the same period of 2021, the entire sector shows extremely positive results both in terms of turnover and orders, with double-digit increases.

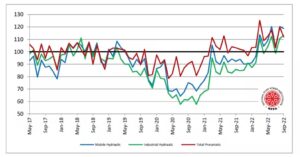

Looking overseas over the same period, the US hydraulics industry also saw positive market conditions in 2021 thanks in part to growth in the manufacturing and heavy equipment sectors. Data from the National Fluid Power Association (NFPA) shows that overall total shipments for the fluid power industry are currently increasing by double digits and the industry is experiencing a positive growth rate of approximately 20% each year. However, the quarterly growth rate is starting to decline and this trend is expected throughout 2022 and most of 2023.

Regarding forecasts, 7% growth is expected in 2022 compared to 2021 and flat growth in 2023 compared to 2022. In 2024, however, a rebound in the growth rate is expected with the acceleration of the overall economy.